N.B. First published on 22/05/17 on Seeking Alpha, NFLX 0.00%↑ was at $190.77, now it’s $485 at peak (52w high). This is the top of my trophy list in 2022.

Summary

Netflix is still a growth stock and now a bargain, given a 50% profit upside within the next 12 to 15 months.

The S&P rating agency keeps ‘BBB’ on Netflix’s long-term credit rating.

Netflix expects positive cash flow and to expand its operating margin to 19-20% in 2022.

Netflix accounts for 9.39% of total global internet traffic share and ranks #2 in video category after #1 YouTube. That's a massive scale.

As of April 2022, 80% of the top 10 shows belong to Netflix and Bridgerton season two accounts for 39.38B viewed minutes, the highest for Netflix and in streaming history.

Summary

Netflix is still a growth stock and now a bargain, given a 50% profit upside within the next 12 to 15 months.

The S&P rating agency keeps ‘BBB’ on Netflix’s long-term credit rating.

Netflix expects positive cash flow and to expand its operating margin to 19-20% in 2022.

Netflix accounts for 9.39% of total global internet traffic share and ranks #2 in video category after #1 YouTube. That's a massive scale.

As of April 2022, 80% of the top 10 shows belong to Netflix and Bridgerton season two accounts for 39.38B viewed minutes, the highest for Netflix and in streaming history.

The first quarter of 2022 is undoubtedly a watershed moment for Netflix (NASDAQ:NFLX) and its investors. Its stock price plunged over 73% from an all-time high of $700.99 in November 2021 and 63% from January 2022's high of $526 to $188.54 as of April 27 closing.

Now its stock price is back to the December 2017 (Q4 2017) level, but the overall business remains strong. With the current rising inflation at a record high rate of 8.5%, this article provides comprehensive data points to determine whether Netflix stock presents an opportunity for a long-term investment bargain. Netflix has a 50% upside and delivered a healthy reversal in a 12 to 24-month time (with the price target of $300, which is reasonable based on Earning Per Share (EPS) of $13-14 and P/E ratio of 21 to 23).

This should be a bargain for a reasonably priced value growth stock and provide a recommendation for portfolio allocation during the rising inflation period. Therefore, a buy rating is given to Netflix stock based on the deep-dive analysis listed below. Investors should gauge a correct entry point as outlined at the end. This article provides insights and synthesis of different data points and signals for growth based on Netflix's activities.

Is the drop in subscriber base and revenue growth fatal?

Overall, the "sell-off was excessive", as Evercore ISI's senior managing director and head of Internet Research Mark Mahaney puts it. Likewise, as Scott Mendelson points out, Netflix and Disney+ (DIS) are the "victim of inflated Wall Street expectations'' during the pandemic.

However, it's not all downhill from here. Netflix's business and financial fundamentals are strong. That resonated with the S&P, which is keeping Netflix's 'BBB' rating for now after it upgraded Netflix's long-term credit rating by two notches to Investment-Grade. The rating agency said, "its current BBB rating should hold as long as cash flow remains positive and increases on an annual basis." Per Netflix Q1 2022 shareholder's letter, it states, "Free cash flow amounted to $802 million vs. $692 million. Netflix continues to expect to be free cash flow positive for the full year 2022 and beyond." In addition, in January 2021, Netflix announced it ended its run of debt instead of borrowing to fund production, and the business could fund itself.

Strong business fundamentals

Netflix isn't a stay-at-home stock. To verify whether the business is in permanent decline, it's important to review the underlying data. The latest stats of viewership demand, global traffic volume and progress in gaming expansion shed the light on Netflix's solid business fundamentals. Netflix has faced several global economic downturns while delivering consistent growth and revenue at a 20% rate.

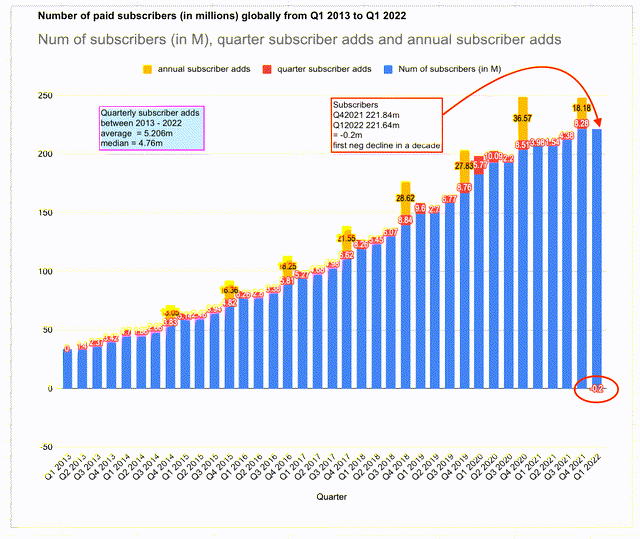

Understandably, some key negative results triggered the loss of confidence, including a decline in subscriber growth for the first time in a decade. They reported a decline of 200,000 subscribers in Q1 2022 QoQ. Netflix expects to lose 2M subscribers in Q2 2022. It imposes legitimate concerns about Netflix's paid subscription business model.

Subsequently, the paying subscriber base decline has dragged down top-line revenue. As of Q1 2022, top-line revenue was $7.87B, equating to a 9.83% YoY growth for the quarter, the first single-digit percentage growth since September 2019 after consecutive double-digit growth in the past. There was also a gradual decline each quarter on a YoY basis throughout 2021.

Meanwhile, according to Antenna Analytics (up to Oct 2021), Apple TV+ loses subscribers at the fastest rate (over 10%), while "Netflix wears the anti-churn crown" at 2.4%.

Part of Netflix's success is due to superior personalization technology. Statistics show that only 20% of viewing comes from direct user searches, but 80% comes from recommendations. In this case, Netflix retains or prevents losing $1 billion or more every year from cancellation because of the superior results from their personalized recommendation engine.

Outperforming the competition, Netflix alone accounts for 9.39% of all internet traffic worldwide ranking #2 in video category in 2021, according to Sandvine global internet report.

Category Traffic ShareGlobal app traffic shareTotal trafficTotal TrafficCategoryTotal volumeAppTotal volumeVideo53.72%YouTube14.61%Social12.69%Netflix9.39%Web9.86%Facebook7.39%Gaming5.67%Facebook4.20%Messaging5.35%Tik Tok4.00%Marketplace4.54%QUIC3.98%File Sharing3.74%HTTP3.58%Cloud2.73%HTTP Media Stream3.57%VPN1.39%BitTorrent2.91%Audio0.31%Google2.79%

(Global internet traffic share categories and ranking)

Even more impressive is that Netflix ranks number three among multi-purpose global mega applications as one of the top six global popular brands. Furthermore, Netflix is the only pure-play among the top six. This shows that Netflix has achieved a massive scale for a single-focus platform.

Application GroupTotal volumeGoogle20.99%Facebook15.39%Netflix9.39%Apple4.18%Amazon3.68%Microsoft3.32%

(Global internet traffic share by top brands)

Large content library and consumption demand

Netflix has the broadest global footprint across 241 countries and a total of 13,612 titles worldwide (though certain countries have access to only a subset of the library). In comparison, Disney+ has about 2,000 titles worldwide and 900 in the UK. It's a significant competitive advantage for Netflix.

Nielsen reports the latest ranking of top 10 most watched titles on streaming platforms. In the week ending April 3, 2022, 80% of the top 10 shows belong to Netflix, with 7.36B minutes viewed. Overall, Bridgerton season 2 accounts for 39.38B minutes viewed in the first 28 days of release (from March 25, 2022), the highest in Netflix's history.

The latest Nielsen report also shows that streaming viewership share continues to increase from 26% to 29.7%, while Netflix viewing share remains at the top and is growing to 6.6% by March 2022. It's higher than YouTube at 6.0% and Disney at 1.8%.

Which growth path has the best positive outlook for Netflix?

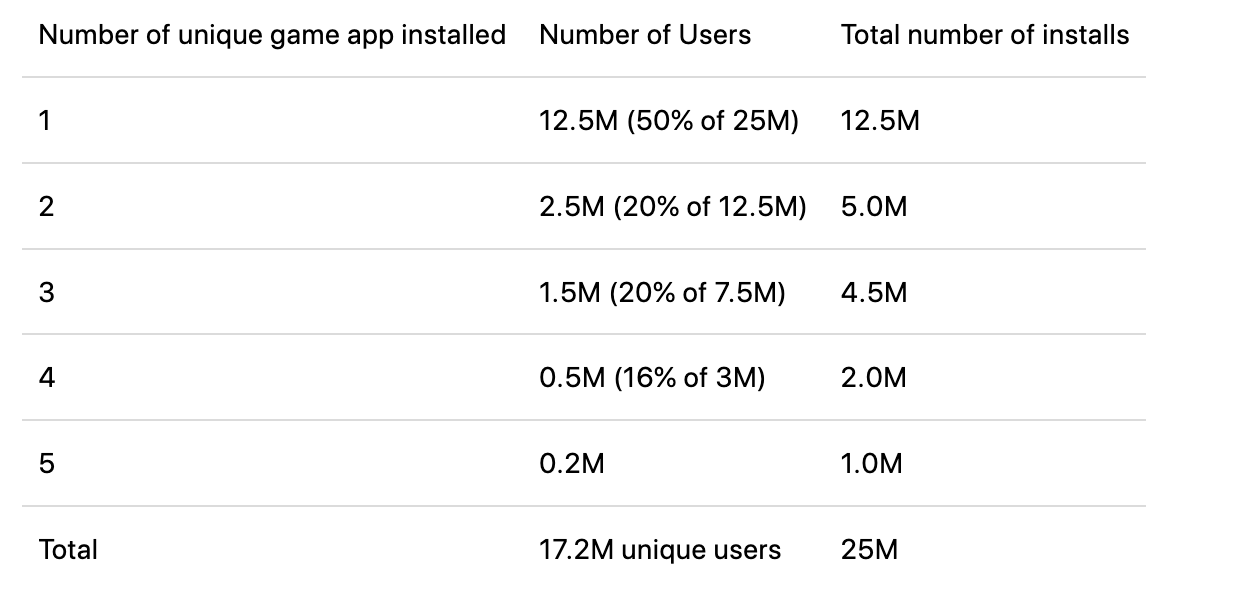

While Netflix hasn't shared any forward guidance on its expansion plan into gaming, the company activities signal the big plans. Gaming is a large and complementary market for Netflix, given its IP licensing, creation and branding strength. Netflix creates a great balance of technology, data analytics and Hollywood know-how. In fact, Netflix sees itself competing with Fortnite more than with HBO. Overall gaming is a synergistic strategy for Netflix to repurpose the successful IPs and content established to expand the growth in subscription.

As seen in 2021, Netflix accelerated the development of mobile gaming via acquisitions. The latest four acquisitions were all in gaming. Undoubtedly, the success of Squid Game has further inspired Netflix's big plans in gaming. In fact, it has fostered many fan-made games and content on Minecraft, Roblox and YouTube.

Aside from acquisitions, Netflix has an extensive list of job openings in gaming and hired high-profile game executives, including veteran Mike Verdu who previously worked at EA, FB game, Zynga, Kabam and others. To accelerate the expansion, Netflix has already quietly published and soft-launched 18 games on Android and iOS stores. The most popular title Stranger Things:1984 has over 1M installs on Google Play.

Successful IP-based mobile games generally garner between 10M to 100M installs. Good examples of this include games from Kabam, Scopely and Next Game (which was acquired by Netflix for $72M). Below is an estimate of Netflix's mobile game penetration in terms of install base by Q2 2023. As of May 2022, Netflix has achieved more than 5.76M installs across 18 games in the past 6 months. In addition, the acquired studio Next Games has more than 15M installs across 2 games based on The Walking Dead's IP. Netflix will likely integrate and launch the The Walking Dead games under the Netflix brand when season 11 is released on Netflix in early 2023. In parallel, Netflix will focus its marketing effort on other IP-based games. Based on the current progress, Netflix will approximately deliver four to five hit games with a combined total of 50M installs by Q2 2023. In the mid-case scenario, one half of the installs are from active Netflix subscribers. Below is a breakdown of the estimated install base. Among 25M installs, approximately one half is from users with one game app installed and the remaining has a mix of two to five game apps. It adds up to 17.2M unique Netflix subscribers and equivalent to approximately 7% of the subscriber base consuming game content. That's a good indicator of solid ground in gaming. It shows Netflix is ready to scale up and provide representative subscriber growth projections after Q3 and Q4 2023. Netflix's current primary focus is on Android devices and the install number is available on Google Play store.

What to expect for 2022's earnings and price target

To reiterate, the target is for a more long-term outlook with at least a 12 to 15-month time horizon. Based on the solid business fundamentals, the target of an EPS greater than $13 to 14 and a $300 price target is reasonable. Given sufficient time, Netflix could readjust and navigate the post-pandemic environment and some other macro factors most companies face.

As Mark Mahaney commented about Netflix stock in an interview, "It's a growth company. But it's no longer a premium growth company." It's likely the growth would slow and not deliver high 20% growth YoY consistently for another decade or two, partly due to the scale of its business, competition and other economic factors. But a low 20% growth top-line and ongoing improvement of the bottom-line would present a good upside. While it's sensible to see the valuation come down and P/E ratio compress, the recent pull-back has gone too far.

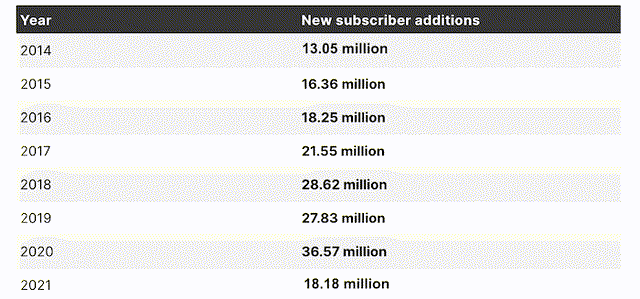

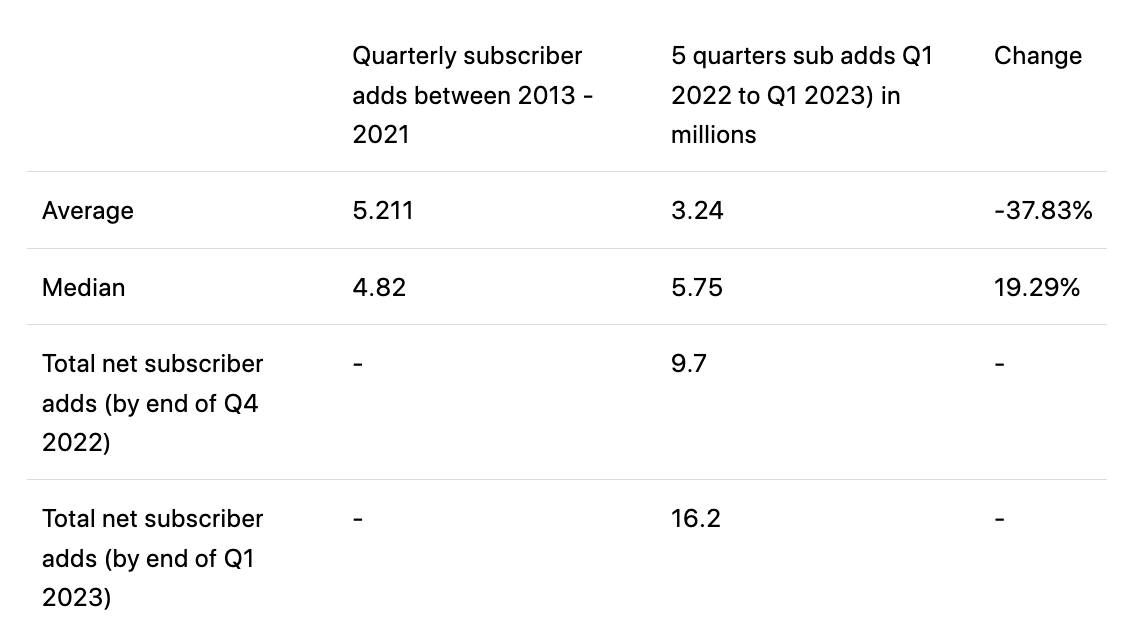

The price target is derived based on top-line revenue, operating margin and declined growth rate in quarterly subscriber adds based on the forward guidance in Q1 2022 earnings. The projection is derived from the top-down approach focusing on the subscriber growth and total subscriber base by Q4 2022 to Q1 2023. From that, the revenue, operating income and net income are derived. As Netflix indicated, they expect a soft new subscriber acquisition in Q1 and Q2, and another -2m in subscriber loss. Meanwhile, based on a few data points, Netflix should still be able to get back on the positive subscriber adds starting in Q3 and Q4 2022.

Reference data points:

1) Quarterly subscriber growth history from 2013 to 2021.

2) Forward guidance in Q1 2022 earnings.

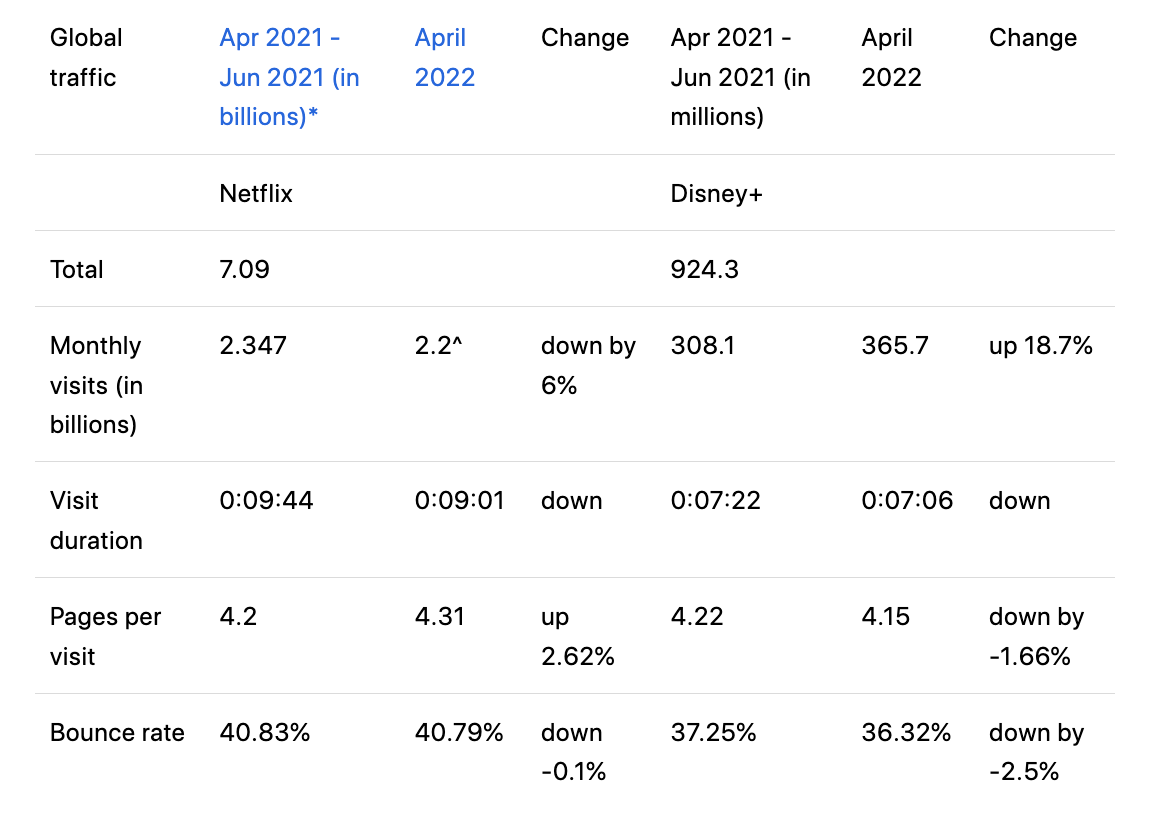

3) Web traffic comparisons between one of the strongest quarters in Q2 2021 and April 2022 traffic-While the global traffic is staying flat for Netflix in April 2022 compared to April 2021, there hasn't been a significant decline. As Netflix continues to expand internationally especially in the APAC, the growth rate will re-accelerate.

* Similarweb Pro account is needed to access the link

^ March 2022, the global traffic was 2.3B

For the base case, the total net subscriber adds would be 16.2m by Q1 2023,which would give Netflix three quarters to re-adjust the strategy and get back to growth mode.

Below is a breakdown of the target for Q1 2022 - Q1 2023:

19-20% operating margin (from 17.23% in Y2021) per Netflix growth outlook.

$10.60 ARM, Average Revenue per Membership (approximate based on subscriber plan downgrades in various regions due to password sharing crackdown and a larger share expansion in international subscriber base. 5% down from $11.16 in 2021).

7.8M monthly average number of accounts pay sub-account fees for sharing accounts outside the household (based on a low estimate of 5% of 100m subscribers) from Q1 2022 to Q1 2023

$5 monthly sub-account fee (approximate based on the fee in testing regions).

5.59M subscriber loss (approximate based on an increased churn rate of 2.52% in 2022, from the prior rate of 2.4%).

16.2M net new subscribers by the end of 2023 (based on a conservative with average quarterly subscriber adds at 3.24M, and 9.7M adds by Q4 2022 which marks a decline from 18.18M annual subscriber adds in 2021. The growth regions are in APAC).

238.04M total subscribers by Q1 2023.

======

Financial targets are listed below based on the above parameters:

$36.52B top-line revenue by Q1 2023 ($35.935B from regular plan revenue and $585M from sub account fees revenue).

$7.304B operating income (approximate based on 20% operating margin, that is 17.9% increase from $6.195B in 2021).

$13.25 EPS (approximate based on 17.9% increase from $11.24 EPS in 2021 ).

$280-$310 price target (21-23 P/E ratio).

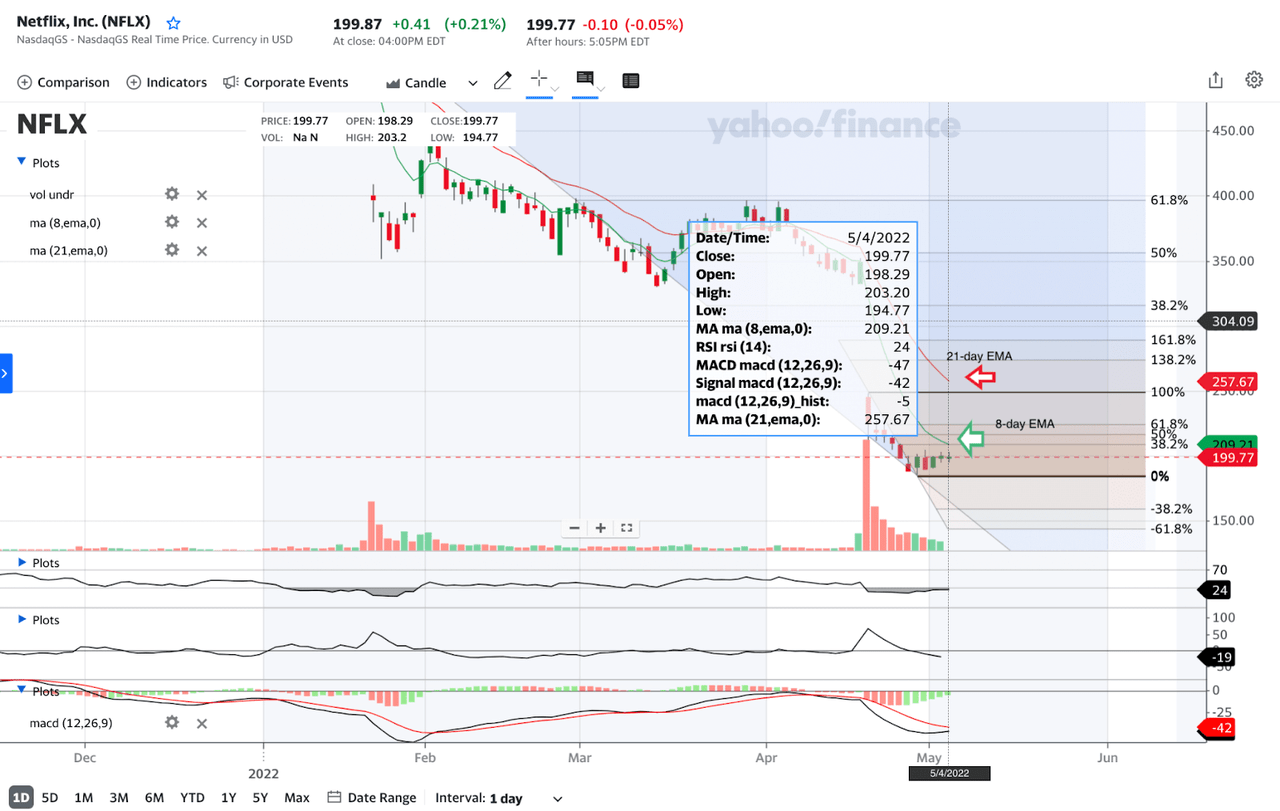

What are the measurable entry points?

The price action and technical analysis of Netflix stock show a downward-trending and weak position. The sell pressure and increased options open interest will continue to keep the stock price volatile In the near term. Overall, open interest has increased to 1.2m contracts, higher than the 52-week average of 729K contracts. Meanwhile, the put/call ratio has dropped to 0.8, which is lower than the 52-week average as of the May 3 closing.

To avoid further downside momentum, negative macro environment and market volatility, a few technical indicators should be used to provide checkpoints. A good entry is when:

CBOE Volatility Index ($Vix) below 25, ideally below 20.

RSI above 30. Currently, it's in the oversold territory.

Upward trend line together with 2-3 Heikin-Ashi candle bullish green bars and upward wicks.

Price above 8-day EMA. For confirmation, wait for an 8-day Exponential Moving Average (EMA) to cross above a 21-day EMA.

Increased volume with upward volume oscillator, that confirms a bullish uptrend.

Based on the current price actions, 8-day EMA is at around $209 and above. If there is strong support at $209, that could serve as the first positive signal. An overall market rally took place as of the May 4th closing. Netflix's stock price rebounded to $204.01 after-market. It's important to observe the trend to avoid a fake rally.

Main takeaways

The overall thesis is that Netflix is a quality growth stock. It outperforms competitors in terms of content library, demand and traffic share. Valuation comes down after overvaluation during the inflated bull run in the past two years from 2020 to 2021. The market volatility, inflation and macro backdrops coupled with two disappointing quarter results led the Netflix stock price to spiral downward. In addition, the downtrend is extended by options unwind and liquidation. However, the company still shows strength, good financial and business fundamentals. The prospect and recommendation aren't for short term trades but rather a long term investment.

In the current market condition, it's important to set a longer time horizon, higher margin of safety and have patience. Netflix should be able to continue delivering steady growth in subscription base and revenue at 10 to 15%, revive the market sentiment and maintain a comparable P/E ratio of 20 to 23. The recent pullback should present a good entry opportunity based on the price target above.